DEBT CONSOLIDATION LOANS

WHAT IS A DEBT CONSOLIDATION LOAN?

Debt consolidation pools together all your outstanding debts—credit cards, student loans, car loans, and more — into a single, larger loan. This loan is then used to pay off those individual debts, functioning much like a typical personal loan.

While it may seem like your debts are merged, they technically remain separate contracts with their own terms and interest rates.

How Does Debt Consolidation Loan Function to Settle Debt?

A debt consolidation loan operates by providing you with the funds necessary to settle your current debt. For instance, if you hold three credit cards with a total debt of $20,000, upon obtaining a consolidation loan from a lender, they will typically lend you the $20,000 if you meet the criteria. Subsequently, they will use this amount to pay off your existing credit cards, close those accounts, and require you to make a single monthly payment towards the $20,000 loan.

However, without a practical household budget in place and actively managed, there’s a risk of falling into the cycle of financial strain again. In such scenarios, individuals may resort to acquiring new credit cards shortly after commencing payments on the personal loan, potentially resulting in the doubling of their debt instead of reducing it through consolidation.

What to keep in mind

When considering an unsecured debt consolidation loan, lenders exercise caution in their approval process. Eligibility typically hinges on factors such as a robust income, substantial net worth (the value of assets minus debts), and a stellar credit score. Alternatively, a co-signer with an impressive net worth and credit history may be required. Beyond these prerequisites, here are further downsides:

- Collateral is often required, adding a layer of security.

- A decent credit rating is necessary for approval.

- Interest rates tend to surpass those of home equity loans (for home refinancing).

- Unsecured debt consolidation loans can entail high-interest rates.

- Without addressing the underlying issue leading to debt accumulation, there’s a risk of requiring another consolidation loan post-repayment of the initial one.

What to know about the interest rates

Interest rates for debt consolidation loans are typically offered by banks and credit unions, which often provide the most favorable terms. Several factors influence the interest rate, such as your credit score, income, net worth, existing relationship with the financial institution, and the availability of collateral for the loan. Collateral can include assets like a newer vehicle, boat, term deposit, or other easily liquidated assets. Banks often prefer collateral that can be easily sold in case of missed payments.

Over the last decade, banks have commonly offered interest rates ranging from 7% to 12% for debt consolidation loans. Finance companies, on the other hand, tend to charge higher rates, ranging from 14% for secured loans to as much as 49% for unsecured ones.

Criteria for a Debt Consolidation Loan

Maintaining a credit score that meets the lender’s minimum threshold, indicating few late payments and minimal negative remarks on your credit report. Demonstrating sufficient income to support loan repayment. Ensuring that your total monthly minimum credit card debt payments are within reasonable limits. Providing adequate collateral or security for the loan. In instances where you fall short of meeting these criteria independently, enlisting a reliable co-signer may increase chances of qualification.

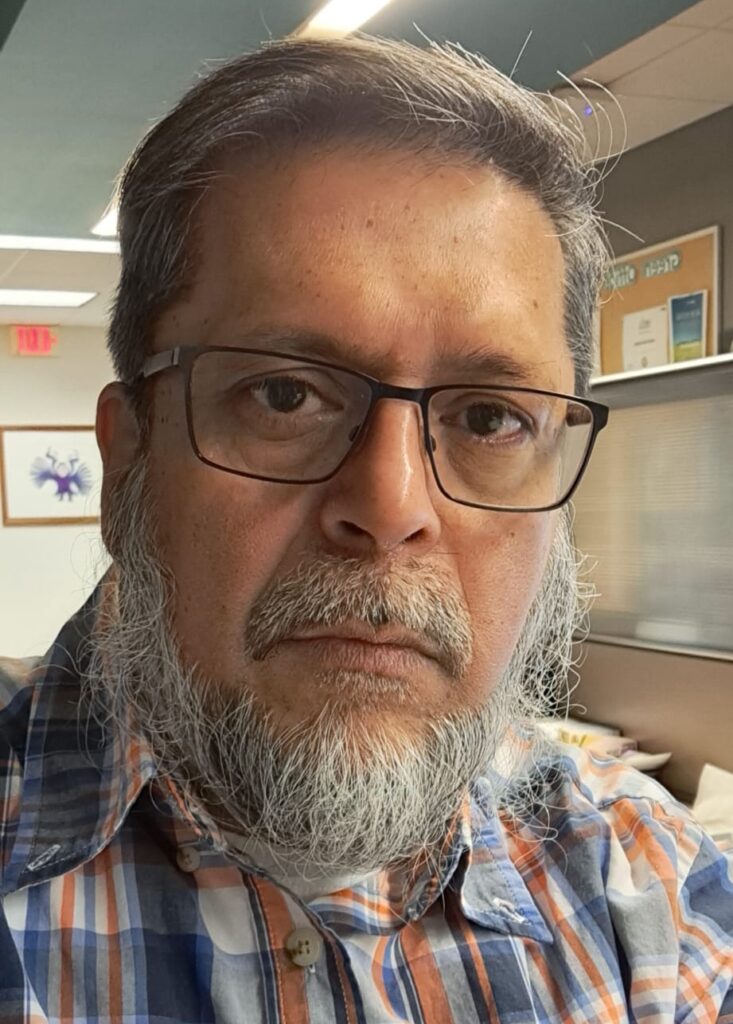

ABOUT MUSTAFA,

YOUR DEBT ADVISOR

Hi, I’m Mustafa — your trusted debt advisor, based in Ontario, CA. My journey of helping folks regain their financial freedom, began back in 2014.

Ever since, I’ve worked with 100’s of individuals with successfully filing their consumer proposal and helping them reduce their debt substantially.

I bring a wealth of experience and knowledge to the table.

I understand that every financial situation is different and believe in personalized solutions that cater to your specific needs.

You can count on me to provide sound advice and an effective strategy for reducing your debt.

I’m here to answer your questions, address your concerns, and work with you on your path to a debt free future.

Whether you’re considering a consumer proposal, need assistance with debt consolidation, or simply want to explore your options, I’ll be your go-to expert.

Let’s connect over a free consultation call to get you started.

Mustafa Ezzy — EEZZEECO Debt Consolidation — Ontario Canada

© Copyright 2024 Mustafa Ezzy @ EEZZEECO. All Rights Reserved.

Support | Terms & Conditions | Privacy Policy