BANKRUPTCY

Bankruptcy offers a legal pathway to wipe out most of your debts, granting you a fresh start and the opportunity to reclaim control of your finances.

WHAT IS BANKRUPTCY?

Bankruptcy is a legal process governed by the Bankruptcy and Insolvency Act in Canada. It offers individuals who are overwhelmed by debt a pathway to financial relief and a fresh start.

Initiating Bankruptcy

- Voluntary Assignment: In this scenario, individuals who are insolvent willingly make an assignment of all their assets for the benefit of all their creditors. This is a proactive step taken by the debtor to address their financial situation.

- Involuntary Assignment: Sometimes, a creditor may file a petition in a provincial court for a receiving order against the debtor’s assets. This is known as being petitioned into bankruptcy and occurs when creditors take legal action against the debtor.

- Deemed Bankruptcy: This occurs when a debtor, who has initiated the insolvency process, fails to meet the requirements for filing a Division I proposal in bankruptcy under the Bankruptcy and Insolvency Act, or does not adhere to the provisions provided within the proposal after it has been accepted by the creditors/court.

Rights of the Bankrupt

Despite bankruptcy, individuals retain certain rights, particularly the right to earn a living. This means that bankrupt individuals are allowed to engage in or continue taxable business activities outside of the bankruptcy estate. However, they must comply with certain regulations and restrictions outlined in bankruptcy laws.

Responsibilities of the Trustee

The trustee in bankruptcy plays a crucial role in managing the bankruptcy process. They act as the agent of the bankrupt individual and have several responsibilities, including handling Canada Pension Plan (CPP) and Employment Insurance (EI) contributions.

If the trustee continues the bankrupt employer’s business, they must obtain a new business number and ensure that CPP contributions, EI premiums, and income tax deductions are handled according to the bankrupt employer’s remittance schedule.

Tax Implications

Payments made by the trustee to settle claims for unpaid wages are taxed as “other income.” This means that these payments do not require CPP, EI, and income tax withholdings. Instead, the trustee must report these payments on a T4A information return.

Bankruptcy provides individuals with a legal process to discharge most of their debts, offering them a fresh start. However, it also comes with specific obligations and responsibilities for both the bankrupt individual and the trustee overseeing the process. Understanding these aspects is essential for navigating the bankruptcy process effectively.

HOW DOES BANKRUPTCY WORK?

STEP 1. Assessment and Consultation

The first step is to speak with Mustafa in a FREE consultation who can assess your financial situation.

During a consultation, Mustafa will review your debts, assets, income, and expenses to determine if bankruptcy is the most suitable option for your situation.

He will explain the process of bankruptcy, as well as any alternatives that may be available to you.

STEP 2. Documentation and Paperwork

If you decide to proceed with bankruptcy, Mustafa will then proceed to work with an LIT who will complete the necessary paperwork.

This paperwork includes an assignment of assets and liabilities, as well as a detailed statement of your financial affairs.

The LIT will also help you prepare a budget and financial plan for the duration of the bankruptcy process.

STEP 3. Filing and Administration

Once the paperwork is complete, the LIT will file the necessary documents with the Office of the Superintendent of Bankruptcy (OSB) to initiate the bankruptcy process.

Upon filing, you will be granted legal protection from your creditors, which means they must cease all efforts to collect on your debts.

The LIT will administer the bankruptcy process, which may involve selling certain assets to repay creditors, attending meetings with creditors, and fulfilling any other obligations outlined in the bankruptcy agreement.

It’s important to note that each individual’s situation is unique, so the process may vary slightly depending on your specific circumstances.

Bankruptcy should be considered as a last resort, only after exploring all other available options for managing your debts. Consult with Mustafa to understand your rights and obligations throughout the bankruptcy process.

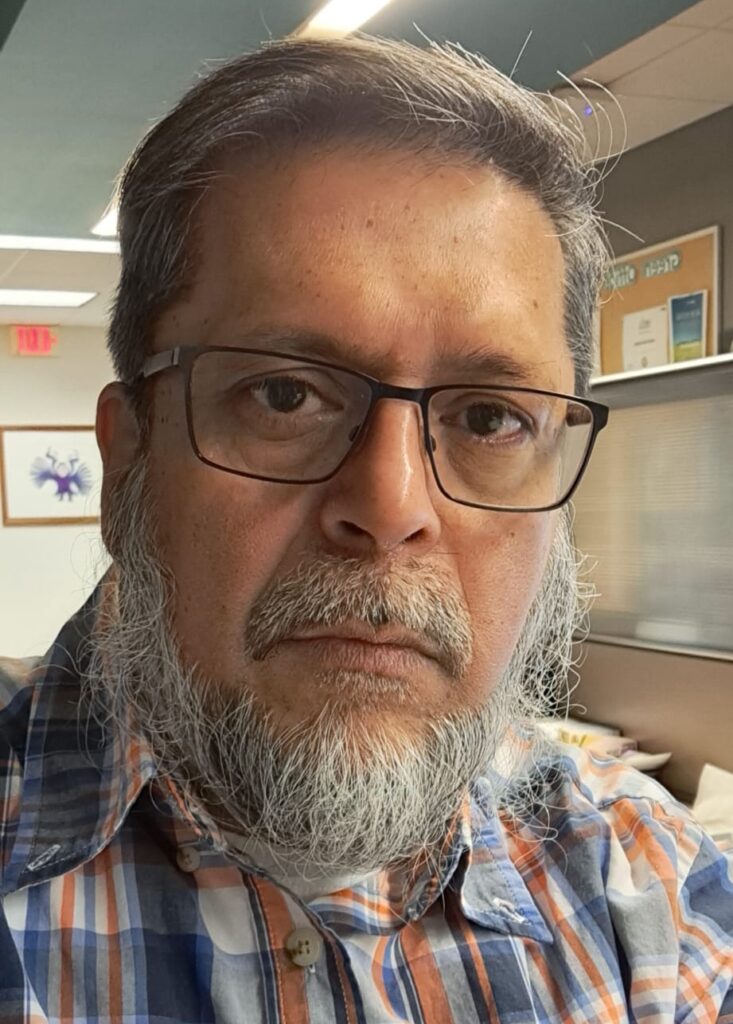

ABOUT MUSTAFA,

YOUR DEBT ADVISOR

Hi, I’m Mustafa — your trusted debt advisor, based in Ontario, CA. My journey of helping folks regain their financial freedom, began back in 2014.

Ever since, I’ve worked with 100’s of individuals with successfully filing their consumer proposal and helping them reduce their debt substantially.

I bring a wealth of experience and knowledge to the table.

I understand that every financial situation is different and believe in personalized solutions that cater to your specific needs.

You can count on me to provide sound advice and an effective strategy for reducing your debt.

I’m here to answer your questions, address your concerns, and work with you on your path to a debt free future.

Whether you’re considering a consumer proposal, need assistance with debt consolidation, or simply want to explore your options, I’ll be your go-to expert.

Let’s connect over a free consultation call to get you started.

Mustafa Ezzy — EEZZEECO Debt Consolidation — Ontario Canada

© Copyright 2024 Mustafa Ezzy @ EEZZEECO. All Rights Reserved.

Support | Terms & Conditions | Privacy Policy