EXPLORE ALL YOUR DEBT RELIEF OPTIONS

Feeling overwhelmed by debt is normal, and Mustafa is here to help. For over a decade, he’s assisted people in distinguishing between ‘good debt’ and ‘bad debt.’ He is dedicated to guiding you towards financial health quickly and responsibly.

DO YOU NEED FINANCIAL HELP?

Discussing finances, especially debt, can be daunting. It’s crucial to recognize when you might need help. Start by asking yourself these questions:

- Do you struggle to pay your bills on time?

- Do you only make minimum payments on your credit cards or sometimes miss a payment?

- Do you exceed your credit card limits, overdraft, or line of credit?

- Have you missed a mortgage or loan payment?

- Are you receiving calls from collection agencies or creditors?

- Most importantly, do you feel stressed and anxious about your financial situation?

Important terms

- Consumer Proposal: A formal agreement to pay back a portion of your debt, facilitated by a Licensed Insolvency Trustee (LIT).

- Insolvency: The inability to pay all of your debts.

- Bankruptcy: A situation where you can’t pay even a reduced amount and must liquidate most of your assets to cover your debts.

7 DEBT RELIEF OPTIONS

There are numerous debt relief options available. Understanding which one is right for you can be challenging. Explore the options below and remember, you can always schedule a FREE consultation with Mustafa to discuss which solution fits your situation.

DEBT CONSOLIDATION LOAN

This type of loan combines all your existing debts, such as credit cards, personal loans, and other liabilities, into a single, manageable monthly payment. This process simplifies your finances by reducing the number of payments you need to make each month. With the help of a bank or other lender, you can often secure a lower interest rate, which can save you money over time and make it easier to pay off your debt. Note: We do not provide loans. LEARN MORE.

CONSUMER PROPOSALS

Filed by a licensed insolvency trustee (LIT), a consumer proposal is a legally binding agreement between you and your creditors to pay back a portion of your debt over a specified period. Under the federal Bankruptcy and Insolvency Act, this process protects you from creditors’ collection actions and stops accumulating interest. It’s an alternative to bankruptcy that allows you to retain your assets while managing your debt more effectively. LEARN MORE.

BUDGETING

Creating a budget involves listing all your monthly income sources and expenses, such as rent, food, utilities, and other necessities. This helps you understand where your money is going and ensures that your spending aligns with your income. A well-structured budget can help you identify areas where you can cut costs, save more effectively, and plan for future expenses, ultimately helping you achieve financial stability.

CREDIT COUNSELLING

A licensed credit counsellor can assess your financial situation and provide personalized advice on managing your debt. They can help you develop a realistic budget, negotiate with creditors to lower interest rates, and create a plan to pay off your debt. Credit counselling aims to help you regain control of your finances, reduce financial stress, and avoid future debt problems.

DEBT MANAGEMENT PLAN

A debt management plan (DMP) is a structured repayment strategy designed to help you pay off your debt over time. With the assistance of a credit counsellor, you’ll create a plan that details how to tackle your debt pressures and make consistent payments to your creditors. The counsellor may also negotiate with creditors to reduce interest rates or waive fees, making it easier for you to pay down your debts and achieve financial freedom.

DEBT SETTLEMENT PLAN

This plan involves negotiating with your creditors to settle your debts for less than the full amount owed. It can be formal, such as a consumer proposal, or informal, involving direct negotiations through a credit counselling firm. A debt settlement plan can significantly reduce the total amount of debt you owe, providing you with a feasible way to manage and eventually eliminate your debt pressures.

FILING FOR BANKRUPTCY

When your financial situation becomes unmanageable, filing for bankruptcy can provide relief. A licensed insolvency trustee (LIT) will oversee the process, which involves liquidating most of your assets to pay off unsecured debts. Bankruptcy, filed under the federal Bankruptcy and Insolvency Act, provides a fresh start by clearing your unsecured debts quickly and affordably. This process also protects you from further collection actions by creditors and helps you rebuild your financial life. LEARN MORE.

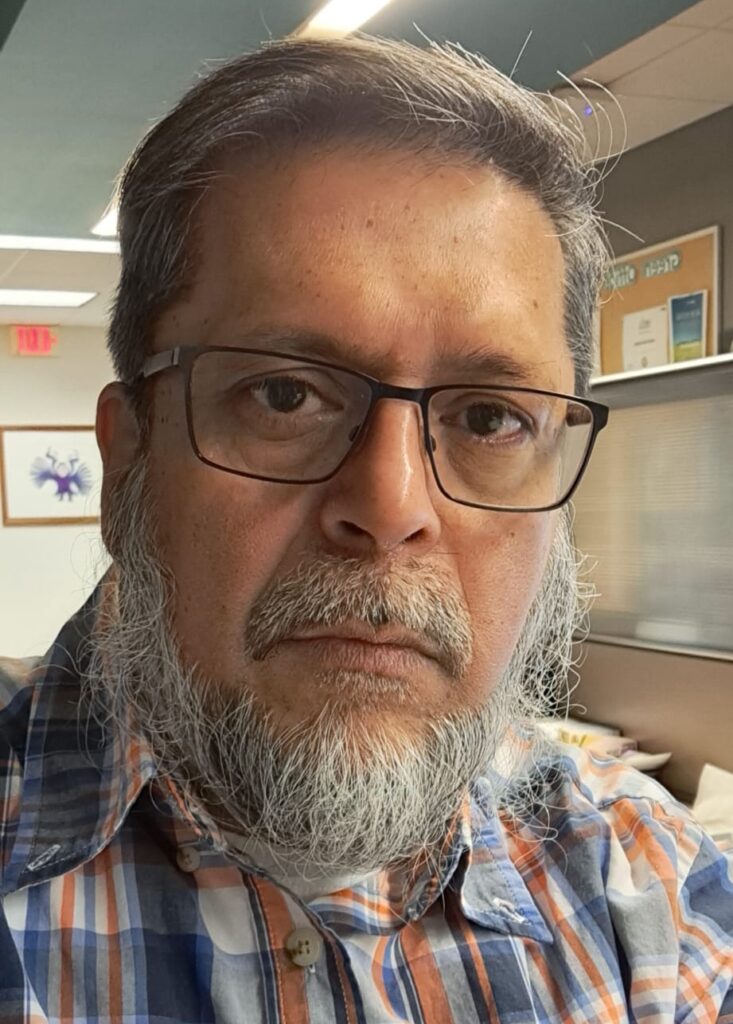

ABOUT MUSTAFA,

YOUR DEBT ADVISOR

Hi, I’m Mustafa — your trusted debt advisor, based in Ontario, CA. My journey of helping folks regain their financial freedom, began back in 2014.

Ever since, I’ve worked with 100’s of individuals with successfully filing their consumer proposal and helping them reduce their debt substantially.

I bring a wealth of experience and knowledge to the table.

I understand that every financial situation is different and believe in personalized solutions that cater to your specific needs.

You can count on me to provide sound advice and an effective strategy for reducing your debt.

I’m here to answer your questions, address your concerns, and work with you on your path to a debt free future.

Whether you’re considering a consumer proposal, need assistance with debt consolidation, or simply want to explore your options, I’ll be your go-to expert.

Let’s connect over a free consultation call to get you started.

Mustafa Ezzy — EEZZEECO Debt Consolidation — Ontario Canada

© Copyright 2024 Mustafa Ezzy @ EEZZEECO. All Rights Reserved.

Support | Terms & Conditions | Privacy Policy